Building a coherent picture of business risk is hard enough – but what about the people behind the business? There’s no guarantee that anyone is who they say they are online. That means financial institutions need to step up their due diligence to ensure applicants are actually linked to the business they claim to be authorized to represent, or risk exposing themselves to fraud.

Applicant Link, the latest feature from TrueBiz, removes the uncertainty and the manual labor from verifying an applicant's connection to a business. A new addition to TrueBiz Web Presence Review, which automates analysis of a merchant’s web presence in under 30 seconds, Applicant Link ingests applicant-provided data, such as the applicant’s email, phone, and address, to prove that they are genuinely tied to the business. It means financial institutions can get a complete picture of both business risk and applicant legitimacy within the same workflow, and onboard new businesses with ease.

Illegitimate applicants present fraud risk

While a business itself might pass a TrueBiz risk assessment, it’s difficult to know if the person making the application is an authorized representative, or a fraudster trying to impersonate ownership of the legitimate business.

Anyone can borrow the public details of an existing business and pretend to be the legitimate owner. Public data sources, like corporate registries, are inconsistent. While in some territories ownership data is readily available, in others it’s piecemeal or completely unavailable. Where registries do provide ownership information, it can actually make life harder for financial institutions attempting to root out bad actors: fraudsters can use the legitimate profiles they find to convincingly impersonate business owners.

This leads compliance professionals down a rabbit hole of Google searching in efforts to match business to applicant. It’s time-consuming and inefficient, and prevents risk and compliance professionals from being able to make secure, informed decisions about the businesses they onboard.

Confidently connect applicant to business

Applicant Link tackles this challenge with several layers of defense that safeguard payments providers from merchant risk.

Submit applicant details

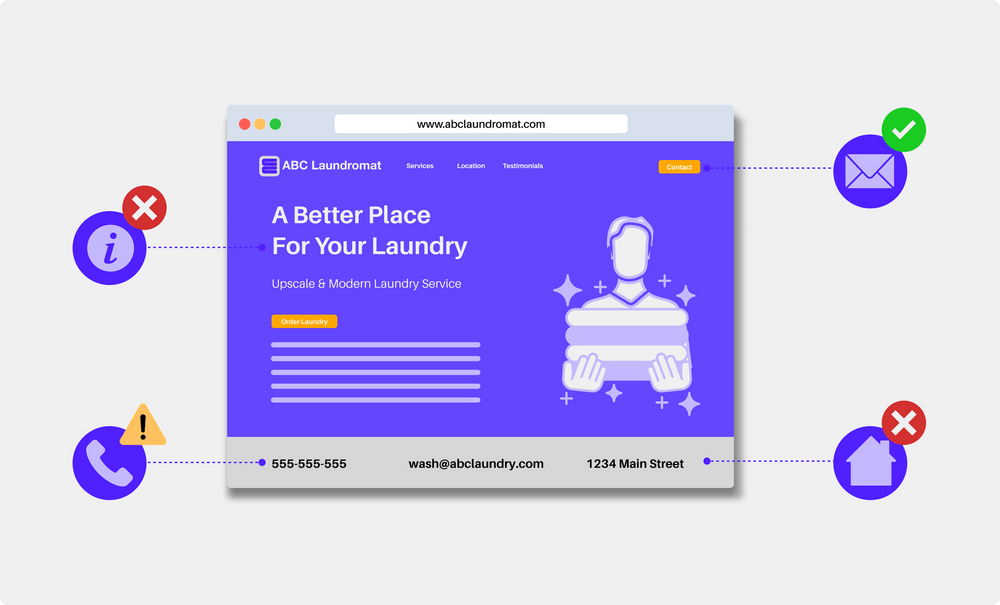

Alongside the URL required for Web Presence Review, you can now also submit the name, email, phone, address and description of the business provided by the applicant.

Rigorously cross-reference

All this information is cross-referenced with the merchant’s internet footprint, including places like their social media profiles and website mentions, to find subtle but significant connections. We analyze discrepancies, like mismatched contact information or suspicious patterns, to flag potential fraud and trigger alerts.

Understand business and applicant risk

In under 30 seconds, financial institutions receive the same rigorous risk assessment of the merchant that Web Presence Review delivers as standard, as well as evidence of the connection between business and applicant.

Through deep cross-referencing, Applicant Link is able to authenticate the information provided by applicants to ensure it is not only accurate, but that phone, email and addresses are active and valid.

It also analyzes the business description provided by the applicant, and compares it to public data about what the business does. This reduces the supportability risk of bad actors passing off the sale of cannabis as ‘herbal remedies’, for example.

Fast, reliable fraud protection

With Applicant Link, TrueBiz provides a holistic view of both the business and the individual representing it. As fraud becomes more sophisticated, and impersonation risk continues to rise, financial institutions urgently need to augment their defenses. Applicant Link gives a deeper level of confidence in business relationships, and streamlines processes to enable secure business verification at scale at scale.

To learn more about how Applicant Link could help you accelerate business verification, book a demo here.

![[object Object]](https://umsousercontent.com/lib_tLlsXzvLpXgGwMwW/4d5zuwob1ddstysx.png?w=260)