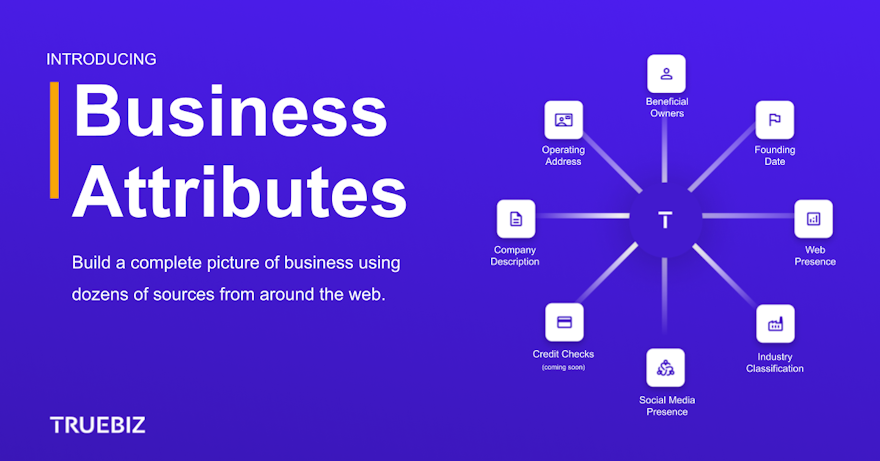

We're excited to introduce Business Attributes – the most efficient way to identify, understand and categorize businesses.

Our API eliminates the need for manual analysts to search dozens of sources from across the web; instead TrueBiz surfaces accurate industry classification, company background, web presence and risk information in seconds.

Understanding what a business actually does is a major factor in deciding whether it gets access to financial services – and how quickly. Traditional methods using NAICS and SIC codes don't work: most FIs end up using a human analyst to Google around and make a judgment call instead. It’s risky, time-consuming, and challenging to scale.

TrueBiz uses just a company name, website or social media profile to instantly unearth 20+ critical data points on the business from around the web. It helps FIs quickly get a sense of a company’s legitimacy, autofill key parts of the application, automate elements of risk assessment, and expedite key accounts.

The way we verify business accounts is broken

To onboard a new business account, you first need to figure out the basics. Is it a real company? Is it in an industry you can service? Who are the key directors? Answering those questions shouldn’t be difficult – but for most FIs, it is.

Sourcing useful data about businesses is often an arduous, manual task.

There’s no single, central, trusted database of business identity data. Registry data is generally inconsistent and incomplete. This means that FIs have to piece together a picture of each business by manually reviewing a wide range of public and private data sources. In cases where they need more information on a business, most FIs still start with a manual Google search. They go to the website to see if the business is active. Maybe they click around a few pages to see if it seems legitimate. They might browse through reviews, trying to figure out how far back the web presence goes. Often they’ll look up some key employees on LinkedIn.

There are problems with this. The first, and most pressing for FIs, is that it’s not scalable. It relies on human analysts to repeat the same process on a case-by-case basis, and that slows down onboarding. And because the process isn’t standardized, it’s error-prone.

The second is that it’s not consistent. The process is rarely standardized. Even if it is, the same data points aren’t available online for every single company. A brand new startup is likely to have a much smaller web presence than an established business with a decade of trading under its belt.

The third is that it’s not reliable. Analysts often go on gut feel about a business, using anecdotal evidence to make a judgment call. It’s a sense check more than anything else, and is therefore exposed to human fallibility.

TrueBiz Business Attributes automates company review

So, what’s the solution? TrueBiz Business Attributes is the most efficient way to find details about businesses. It doesn’t need an analyst to blindly Google around: using just a company name, website or social media profile, TrueBiz Business Attributes unearths 20+ data points from around the web, helping you build a reliable picture of new business accounts in seconds.

Building a complete and accurate picture of businesses requires a wide range of data sets to be connected, normalized and assessed. Doing it at scale requires that process to be automated. Our simple API asks four key questions, rapidly returning the critical information you need to onboard new businesses:

Industry Classification: surfaces highly accurate categorization of what the business does within 400 possible industries

Company Background: delivers key data about the company and its owners from disparate sources around the web

Web Presence: analyzes the website and the broader web presence for data points and risk

Risk Assessment: weighs passive fraud signals from dozens of different sources

A better way for FIs to onboard new business

Business Attributes doesn’t only speed up the onboarding process for FIs: it also enables more efficient, customer-centric and personalized workflows.

Automate Risk Assessment

Manual risk assessment is slow and inconsistent. Business Attributes replaces Google searches with a single API call to surface critical data in seconds.

Expedite Key Accounts

Today, every new business – large or small – goes through the same queue for verification. That’s unnecessary. Companies with strong digital footprints should be quicker and easier to onboard than small companies with none. With Business Attributes, you can segment the companies that justify white-glove service and expedite these as key accounts.

Autofill Applications

With the data TrueBiz returns you can use just a verified company email to complete the majority of the application; Business Attributes autofills the rest. It removes the need for lengthy applications and provides a more complete and accurate picture of the business. It’s quicker, more consistent and crucially, scalable.

What's next

We’re rapidly expanding the type and range of data we’re ingesting, and would love to get your input about what matters most. If new business account onboarding is a blocker in your business, and you’d like to help shape the future of risk assessment, get in touch.

We’d love to run a free test on your data, and see if we can make life easier for your customers, and your team. Book a demo here.

![[object Object]](https://umsousercontent.com/lib_tLlsXzvLpXgGwMwW/4d5zuwob1ddstysx.png?w=260)