Challenge: Manual verification processes add friction and risk to merchant onboarding

Lightspeed Commerce (NYSE: LSPD), a leading provider of POS and payment services, faced challenges in its merchant onboarding process. Manual verification was creating bottlenecks and slowing down the onboarding of legitimate merchants. This challenge has been exacerbated by the advancements in generative AI. This new technology has made it easier than ever for fraudsters to create a legitimate-looking merchant web presence, further complicating the verification process.

Director of Risk Operations, Basil Dajani, recognized the need for a more efficient and holistic risk assessment to support Lightspeed's rapid growth without compromising on risk. The previous manual underwriting process involved sifting through numerous online sources to evaluate a merchant's credibility and establish if it’s a business they can support. This was time-consuming and prone to inconsistencies. The lack of a systematic approach to identify high-risk merchants meant that all applicants were subjected to the same detailed manual workflow, unnecessarily delaying the onboarding of low-risk merchants.

The company could not sustain exponential growth if it had to keep hiring analysts in a linear manner. There was a pressing need to automate industry compatibility checks and fraud screening to remove friction from the user experience and make onboarding more scalable. All this had to be done without adding headcount or additional risk.

Before finding TrueBiz, Lightspeed explored solutions that could either conduct checks to ensure the merchant was in a supportable industry or perform fraud checks. None could seamlessly do both. This limitation made it challenging to streamline the onboarding process, as critical data points on the merchant weren't effectively communicating with each other to provide a holistic perspective on the merchant’s profile.

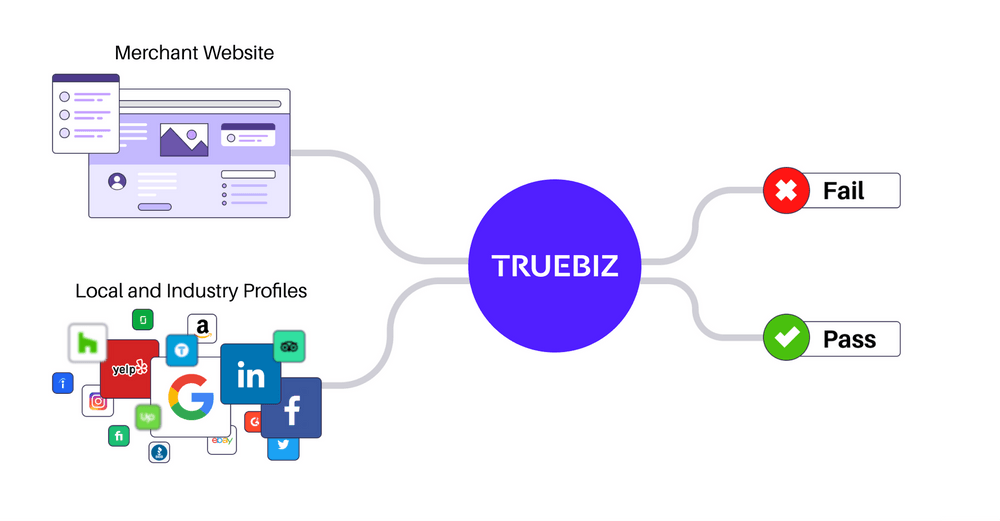

Solution: TrueBiz provides a unique balance of merchant profiling and fraud assessments

In TrueBiz, Lightspeed found a vendor that could ingest a wide variety of data on a merchant from all across the web. In under 30 seconds, the TrueBiz API would return a clear and detailed profile of the merchant, together with a configurable risk score.

During testing, Lightspeed was particularly impressed at the near-perfect correlation between TrueBiz risk assessment and Lightspeed’s own analysis. 99.5% of merchants that Lightspeed had originally approved but later resulted in losses were identified correctly by TrueBiz as high risk. There was also a very strong positive correlation between merchants Lightspeed had approved and what TrueBiz passed. TrueBiz was able to accurately classify these merchants in seconds. This was a fraction of the time it typically took Lightspeed analysts to review them.

While the speed of the response enabled much faster decisioning, the breadth of signals TrueBiz analyzed provided more confidence in the legitimacy of the merchant.

Lightspeed saw great value in being able to weave together hundreds of different aspects of a merchant’s profile to see if the company had a coherent narrative. This holistic view of a merchant's online presence, including their website, social media activity, customer reviews, and other public records, enabled Lightspeed to assess whether the merchant's story was consistent and credible. By synthesizing this information into a clear and concise response, TrueBiz helped Lightspeed gain a deeper understanding of each merchant's business operations and risk profile. This enabled more informed and accurate decision-making in the onboarding process, while minimizing the risk to the business.

The integration with TrueBiz’s API was very smooth, and even completed a few days ahead of schedule. Having the attention of a customer-focused company like TrueBiz made the Lightspeed team feel especially supported throughout the process, which was collaborative and transparent.

The Results

TrueBiz has become an integral part of Lightspeed's underwriting process, transforming the way the company approaches merchant onboarding and risk assessment.

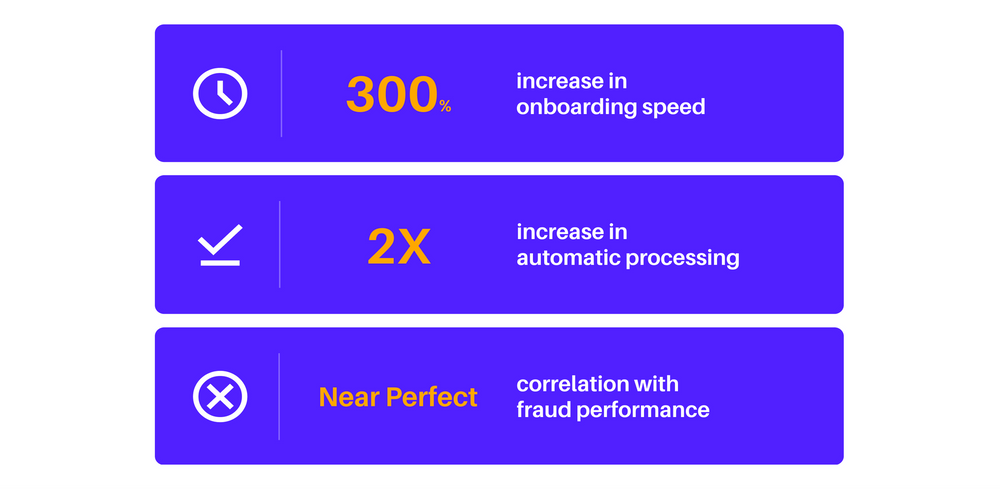

300% increase in onboarding speed

The integration of TrueBiz has automated many of the processes that previously required manual review, such as reviewing the merchant’s social media pages and reviews. This automation has reduced the need for manual intervention, allowing Lightspeed's risk operations team to focus on more complex cases and strategic initiatives.

TrueBiz also significantly speeds up the process for cases that still require manual review. The detailed merchant profile returned enables analysts to quickly access comprehensive data and make informed decisions without needing to spend time browsing the merchant’s web presence. These processes that could sometimes take 30 minutes are now being performed in less than a minute.

2x increase in straight-through processing

TrueBiz's rapid analysis has resulted in a rapid acceleration of Lightspeed's automated decision making. By providing detailed merchant profiles and risk assessments in seconds, TrueBiz has enabled Lightspeed to onboard merchants, particularly ecommerce with an unprecedented efficiency. This has facilitated a better onboarding experience for the best merchants, and more effective reviews for the cases that need more due diligence.

Near-perfect correlation with fraud performance

TrueBiz's advanced risk assessment capabilities have enabled Lightspeed to identify and mitigate potential fraud and credit risks more effectively. In an assessment of historical data, TrueBiz has shown to return a near perfect correlation with Lightspeed’s own risk assessment for the merchants.

TrueBiz's impact goes beyond initial onboarding. It is now integral to the workflows of enhanced due diligence, fraud, and credit teams at Lightspeed. These teams utilize TrueBiz to ingest previously difficult to ingest data into their real-time decisioning processes, enabling them to identify fraud and credit risk issues. TrueBiz’s ability to provide a comprehensive understanding of a merchant's profile enhances Lightspeed's risk operations, contributing to a significant reduction in risk on the platform.

About Lightspeed

Lightspeed is the unified POS and payments platform powering the world's best businesses in over 100 countries. The partner of choice for ambitious retail and hospitality entrepreneurs, Lightspeed simplifies processes across teams, channels and locations to help accelerate revenue growth and provide the best customer experience.

To learn more about TrueBiz visit our website to book a personalized demo.

![[object Object]](https://umsousercontent.com/lib_tLlsXzvLpXgGwMwW/4d5zuwob1ddstysx.png?w=260)