Challenge: Manual merchant verification processes drain resources and increase the risk of fraud

A critical aspect of Visa Cross-Border Solutions onboarding process is a thorough analysis of the merchants online presence to assess the likely risk for fraud and compliance issues.

But verifying the nature of a merchant’s business was extremely manual. Visa’s team of human analysts were spending 10-20 minutes verifying each new merchant website. The process involved painstakingly analyzing the website against a checklist of criteria, taking notes and screenshots. This often resulted in needing to reach back out to the merchant for further details. The process was slow, inconsistent and completion time was dependent on the strengths of the individual analysts.

Solution: TrueBiz automates merchant risk review for greater efficiency and fraud prevention

The Visa Cross-Border Solutions team knew that it needed an agile solution that leveraged the latest technology to speed up the process, empower its analysts and respond to the ever-evolving fraud landscape. It quickly became apparent that legacy providers would be unable to deliver. Their products weren’t designed for real-time decisioning and lacked the depth of data needed to make conclusive judgements, particularly for smaller merchants.

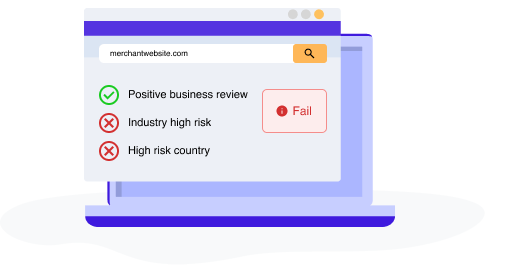

In TrueBiz’s Web Presence Review they found an API-first solution that automates the review of hundreds of subtle signals from across a merchant’s web presence in under 30 seconds. Data is analyzed using proprietary machine learning algorithms to give Visa a straightforward pass or fail recommendation, together with a detailed profile of the business and the reason for the decision. Decision logic is configurable to their particular risk preferences, coupled with TrueBiz’s deep industry expertise.

When testing the solution with a sample of data, the Visa team was impressed by the depth of detail TrueBiz was able to uncover about merchants in a near real-time response, and how configurable the risk decisioning was within the system. The level of support provided by the TrueBiz team also gave confidence that this was a vendor who would proactively iterate and improve the solution in a true partnership.

Results: TrueBiz empowers Visa Cross-Border Solutions to securely scale merchant onboarding

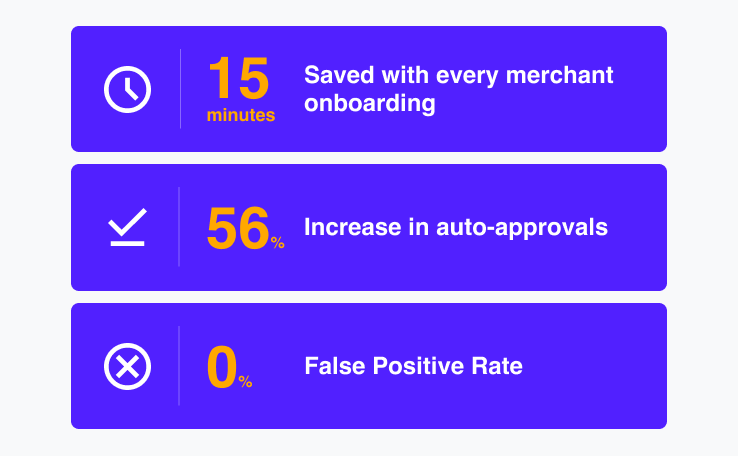

Implementation was easy. Within a matter of weeks the team was using TrueBiz’s integration with Moody’s PassFort in their automated workflow resulting in a 56% increase in automated recommendations. TrueBiz now powers automated merchant web presence review at onboarding, with plans to embed the solution within Transaction Monitoring and Investigation too.

The partnership has driven significant efficiency gains. Checks that were previously taking 10-20 minutes now take an average of 17 seconds. This enables the team to ramp up both the volume and speed of onboarding.

Because TrueBiz adds many more signals to what was previously a relatively one-dimensional risk check, they are also able to weed out bad actors earlier, and reduce the risk of fraudsters and prohibited merchants from accessing the platform. In analysis of live searches, the false positive rate has been 0% giving much confidence on the decision logic.

Visa estimates that TrueBiz's automation of merchant web presence reviews has effectively saved the cost of a full-time analyst. Its existing team of analysts is empowered to perform better too. The detailed analysis of the merchant returned by TrueBiz enhanced analysts' decision-making quality, particularly for higher risk cases. The analysts have appreciated having a world-class solution to optimize their work, and required little training to use the intuitive solution.

If you are interested in discovering how TrueBiz can help your risk and underwriting teams streamline their processes schedule a demo today.

About Visa Cross-Border Solutions

Visa Cross-Border Solutions facilitates the movement of money around the world. Its payments infrastructure empowers them to move money wherever and wherever their clients need it. They have processed over $250 billion to more than 180 countries. As it continues to scale and offer its multi-currency, cross-border embedded finance solutions to more global customers, operational efficiency is key.

![[object Object]](https://umsousercontent.com/lib_tLlsXzvLpXgGwMwW/4d5zuwob1ddstysx.png?w=260)